You can start collecting

Social Security when you turn 62 years old.

The

amount you receive each month is based upon your top 35

years of lifetime indexed earnings. (Indexed

earnings... the amount is adjusted for inflation.)

You need to

work at least 10 years (40 credits) to qualify for

Social Security benefits.

If you decide to start receiving

benefits at age 62, the amount you receive will be

reduced by 30% from the amount you would receive at

your FRA... or Full Retirement Age. (For those of us born in the

year 1960 or later, our FRA is age 67.

Throughout this document, I will assume your Full Retirement Age is also

67.)

As an example, if your FRA monthly benefit amount is

$1,000 and you choose to collect at age 62, your monthly

benefit amount will be reduced to $700.

$1,000 x (1 - .30) = $700

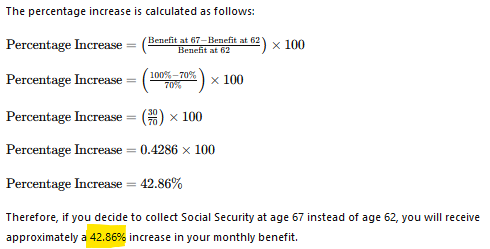

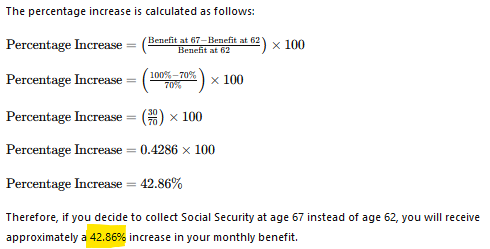

It's interesting to note if you

wait until age 67 to collect, the monthly amount you will receive

is 42.86% more than the amount you would have received

at age 62!

To clarify, $1,000 is 42.86% more

than $700. ($1,000 - $700) / $700 = .42857

So

yes, both statements are true. When you mention a reduction

in benefits from FRA, 30% is the correct figure

to quote. When you mention an increase from your age 62

benefit, 42.86% is the correct figure to quote.

Edit: HA! Just for fun, I asked ChatGPT the following

question: What percentage increase will I receive if I decide

to collect social security at age 67 rather than age 62?

I

actually didn't expect to see the proper percentage in the answer.

Usually websites that describe and talk about Social Security benefits

at various ages will quote the reduction amount from FRA, the

30% reduction.

However, I was pleasantly surprised to see this in the response

box:

For every month that you delay in filing, your benefits are

increased by a specific percentage. This percentage increases each

and every month until you reach age 70. You can file for

Social Security any month you choose, after age 62.

Between the

ages of 62 and 64, the monthly increase in benefits is 5/12 of

1%, or .0041667. This percentage

increases slightly from age 64 to age 67 your Full Retirement Age, with

a monthly increase of 5/9 of 1% or .0055556.

From age 67, if you continue to delay filing, your monthly benefit

amount is now increased even more, to .0066667 each

month. After 12 months, this is a total increase of

8%. (.00667 x 12 = .08)

After two full years, at

age 69, this monthly benefit increase will result in a percentage that

is exactly 16% more than your FRA amount. By age

70 it will be a full 24%. (.00666667 x 36 months

= 24%)

At the bottom of this page, there is a chart which lists

the percentage of FRA amount you will receive at every month, from 62 up to

age 70.

EARNINGS LIMIT

If

you are younger than full retirement age and earn more than the yearly

earnings limit, your benefit amount will be reduced.

The limit only applies if you claim Social

Security before reaching your full retirement age.

If you are

under full retirement age for the entire year, $1 will be

deducted from your benefit payments for every $2 you earn above the

annual limit. For 2024, that limit is $22,320.

In the year you reach full retirement age, $1 will be deducted in

benefits for every $3 you earn above a different limit. In 2024, this

limit on your earnings is $59,520. The Social

Security Office will only count your earnings up to the month

before you reach your full retirement age, not your earnings for the

entire year.

However, you get this reduction back...

eventually. You don't get it back in a tidy sum, all at once.

(Too easy that way, right?) What Social Security does instead is

increase your benefit when you reach full retirement age to account for

the previous withholding.

BREAK-EVEN AGE

Your break-even age is the age at which point

you'd will are now about come out ahead by delaying Social Security

benefits.

Everyone's SS break-even age is the same... it is

not based upon each person's individual income or benefit amount. It's a simple

formula. The formula is this:

# of months until break-even = #

of months difference between the two ages x (1 - the early retirement

age reduction amount) / percent of PIA relative to the early retirement

age.

(PIA = Primary Index Amount, aka, the amount you will

earn at age 67, FRA.)

A few examples

should

help clarify.

Let's assume you wanted to know what the

break-even age is between filing at age 62 and filing at age 67:

# of months difference between the two ages is

60. ((67 - 62) x 12 = 60 months)

1 minus the SS reduction amount if you collect

at age 62 is 70%. (1 - .30 reduction = .70)

Percent of PIA relative to the early

retirement age is 30% (30% reduction + 0% "bonus")

60 x .70 / .30 = 140 months until break-even

age

140 months /

12 months per year = 11.67 years. From age 67 that would be

78 & 8 months.

To clarify, at the age of

78 & 8 months, a person who decided to wait and collect SS at age 67,

would now have received exactly the same amount of benefits as a person

who chose to collect at age 62.

You can verify this with actual

figures. For example, let's again assume a person chose to collect

at age 67 and received $1,000 each month. After 140 months their

total benefits received would be $140,000. The person who

collected early at age 62 received benefits for an additional five years,

or 200 months... but each benefit check was only $700. $700 x 200

months = $140,000, the exact same amount.

Here's another

example. Let's say you wanted to know what the break-even point is

from age 62 to 70:

# of months

difference between the two ages is 96. ((70 - 62) x 12 = 96 months)

1 minus the SS reduction amount if you collect

at age 62 is 70%. (1 - .30 = .70)

Percent of PIA relative to the early

retirement age is 54% (30% reduction + 24% "bonus" for waiting 3 years

to collect)

96 x

.70 / .54 = 124.44 months until break-even age

124.44 months / 12 months per year = 10.37

years. From age 70 that's age 80 & about 4.5 months.

To clarify, at the age of 80 & 4.5 months, a person who decided to

wait and collect SS at age 70, would now have received exactly the same

amount of benefits as a person who chose to collect at age 62.

Again, let's verify it. Starting at age 70, 124 months x $1,240

($1,000 per month + $240 percentage increase for waiting until age 70 =

$1,240) = $153,760.

The person who chose to collect at age 62 collected $154,000 during that

same time span. (124 months + 96 additional months, from age 62 to

80... 8 x 12) After next month, the person who waiting until age

70 collect will now receive more.

Here's a

final example. Let's say you wanted to know what the

break-even point is from age 67 to 70:

# of months difference between the two ages is 36. ((70 - 67) x 12 = 36

months)

1 minus

the SS reduction amount if you collect at age 67 is 100%. (1 - 0

= 1)

Percent

of PIA relative to the early retirement age is 24%. (0% reduction + 24%

"bonus")

36 x

100 / .24 = 150 months until break-even age

150 months / 12 months per year = 12.5

years. From age 70 that would be age 82 & 6 months.

To

clarify, at the age of 82 & 6 months, a person who decided to wait and

collect SS at age 70, would now have received exactly the same amount of

benefits as a person who chose to collect at age 67. (If that

seems like a long time, note that just after six and a half years, you've already

received nearly 85% of the amount the person collected who began

receiving benefits at 67. More on

this below, in the WHEN SHOULD I FILE section.)

In online forurms I often read from members

who chose to file at age 62 because they "did the math" and

they would have been 85 years old before the reached their break-even

age. (One member mentioned 87 and another member mentioned 92!) That's not

correct at all. They didn't calculate the break-even age correctly. Again, it makes no difference the

amount of your benefit, which is different for everyone. The

break-even point is the same.

Here 's another formula to use, to

determine the break-even point between any two years, by using the two

benefit amounts.

#

of months until break-even = (age then - age now) x 12 months x ss

amount at early age / difference in two amounts

For example, using the same figures as earlier ($1,000 as the

PIA at age 67 and $700 as the amount received at age 62) the numbers would look like

this:

# of months to break-even = (67 - 62) x 12 x 700 / 300

5

x 12 x 700 / 300 = 140 months... the same answer arrived at earlier.

140 months from age 67 is age 78 & 8 months.

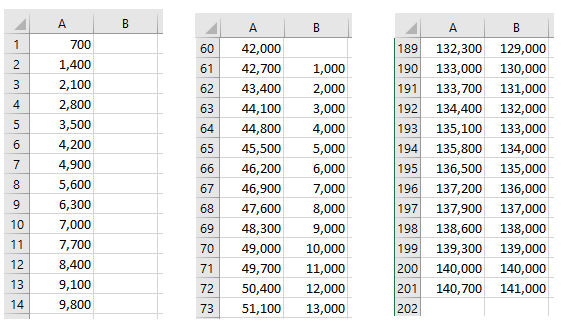

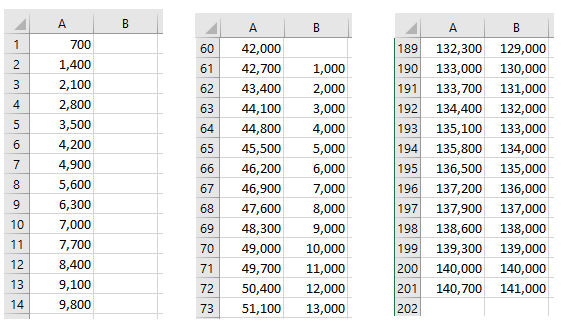

Or course, you don't need a formula at all. Another method to

determine that break-even point is to keep track of

the accumulated total using any spreadsheet. In the graphic below,

Column A's total is increased each month by $700. Column B's

accumulated total is increased each month by $1,000. (Be sure to

start Column B's total five years after Column A.) After

140 months of benefits in Column B, the two accumulated amounts are now identical.

(After that, Column B's

total will always be greater, of course.)

As soon as you reach the break-even age, your

total benefits received whether you filed early or late... are always

equal. That's what the break-even age is. If you

claimed your SS benefits early, you received more checks... but each

check was a bit less than the person who delayed in filing. The

person who delayed in filing received fewer checks..., but each check

was a bit larger. But for both individuals, the total amount

receives is the same.

COLA

The purpose of the cost-of-living adjustment (COLA) is to ensure

that the purchasing power of Social Security benefits and SSI payments

is not eroded by inflation.

Please note that all of the

break-even points, for any two years, is not dependant on your benefit amount or on COLA.

Below is a list of the past ten years of COLA increases:

|

Year |

SS COLA

Percentage Increase |

|

2014 |

1.7 |

|

2015 |

0.0 |

|

2016 |

0.3 |

|

2017 |

2.0 |

|

2018 |

2.8 |

|

2019 |

1.6 |

|

2020 |

1.3 |

|

2021 |

5.9 |

|

2022 |

8.7 |

|

2023 |

3.2 |

| Average |

2.75 |

BREAK-EVEN AGE with COLA

The break-even age discussed above

is the basic, break-even age. It does not take into account COLA, which it probably should,

since most years you will likely see a COLA increase.

COLA, the cost of living

adjustments, will lower the break even age. Here's an

example:

We've already seen how the basic

break-even age is age 78 and 8 months, when comparing taking Social

Security at age 62 to age 67. Now let's see how this changes when

we add in some yearly cost of living adjustments.

For this first example, let's

assume a COLA of exactly 3%... i.e. a 3% increase in the benefit amount per year.

Let's also assume a person will collect $1,400 a month at age 62, and

thus will collect $2,000 a month at age 67.

That first year, the 62-year-old

collected a total of $16,800. ($1,400 x 12 months) The next

year their benefit amount is 3% more each month, or $1,442. This

will give them an additional $17,304, and a grand total of $34,104.

Their third year their monthly

benefit amount has again increased by 3% and is now $1,485.26.

Thus, after that third year, they've now received a total of $51,927.12.

($16,800 + $17,304 + $17,823.12 = $51,927.12)

Continuing in this manner, at the

age of 76 and five months, they've collected a total of $297,638.37.

And at that age the person who

collected at age 67 will have collected just a tad more, or $297,778.42

The person who collects at age 67

also received the benefit of those first five years of COLA adjustments.

(Yes, they do.

You get adjustments for any years between your first eligibility (at age

62) and your filing date.) That persons's first year

of benefits will be a monthly benefit amount of $2,318.55. ($2,000

that first year, then a 3% increase to $2,060, then a 3% increase to

$2,121.80, etc., to $2,318.55 after five years.)

That first year they will have

received $27,822.58. (2,318.55 x 12 months.) That second

year they will have received 28,657.27 (2,388.19 x 12 months) for a

total of $56,479.63.

Continuing in this fashion, at the

age of 76 and five months their total benefit is, as mentioned above, is

$297,778.42.

The break-even age has been

reducted by more than two years. This reduction in time is true,

of course, for any benefit amount, not just the example I used here.

And not the larger the COLA increase, the earlier the break-even age is.

For example, using a 3.5% COLA increase each year, the break-even age

would be age 76 and two months. A full 4% would reduce it to age

75 and eleven months.

ACTUARIAL LIFE TABLE

Actuarial tables (also called life expectancy

tables, mortality tables,and life tables) are statistical tools used by

companies, scientists, courts, and government agencies to predict the

life expectancy of a person by their age, gender, and other factors.

A small portion of the actuarial table found on the ssa website

is displayed below.

The average 62-year-old male will live

another 19 years. The average 62-year-old female will live another

22 years.

According to the SOA, a non-smoking, 65-year-old

male in excellent health today has a 43% probability of living to age

90, and a similar 65-year-old female has a 54% probability of living to

90. One-third of today’s 65-year-old women in excellent health and

about one in four men are expected to be alive at 95.

You may

have read that the current life expectancy is around 76 years old, and

if so, there's no reason to wait to claim benefits if the break-even age is

near age 79. Uh... no. That life expectancy age of 76 is for someone

who is born today. For someone who has already reached the age of

62, they can now expect to live longer than age 76.

|

|

Average Number of Years of Life Remaining |

| Age |

Male |

Female |

|

62 |

19.00 |

22.07 |

|

63 |

18.31 |

21.29 |

|

64 |

17.63 |

20.52 |

|

65 |

16.95 |

19.75 |

|

66 |

16.29 |

18.99 |

|

67 |

15.63 |

18.23 |

|

68 |

14.98 |

17.48 |

|

69 |

14.33 |

16.74 |

|

70 |

13.69 |

16.00 |

|

71 |

13.06 |

15.27 |

|

72 |

12.43 |

14.56 |

|

73 |

11.82 |

13.85 |

|

74 |

11.21 |

13.16 |

|

75 |

10.62 |

12.49 |

|

76 |

10.05 |

11.83 |

|

77 |

9.49 |

11.19 |

|

78 |

8.95 |

10.57 |

|

79 |

8.42 |

9.96 |

|

80 |

7.92 |

9.38 |

PONZI SCHEME?

Social Security is not a Ponzi

scheme. This idea is based on a fundamental misunderstanding of

what Social Security is.

It is not an investment program or a

savings program.

It is a social insurance program.

Anyone

who looks at the program in terms of what someone got back vs. what they

paid in is completely missing the point. The program is, and always has

been, primarily a “pay as you go system.” Money paid into the system by

current workers almost all goes to pay current recipients. It’s only

because of the demographic anomaly that we call the Baby Boom that we

had to establish the Social Security Trust Fund and ask that

generation to partly fund the program for themselves.

It is

nothing like a Ponzi scheme; anyone who says it is either doesn’t

understand Social Security, doesn’t understand Ponzi schemes, or both.

First, one of the most essential rules of a Ponzi scheme is that the

actual functioning is hidden. Otherwise, it collapses. Of course, it

collapses anyway. There are no secrets about Social Security.

Second, Ponzi schemes exist to enrich the people who run the Ponzi

scheme. They only pay early investors in order to keep the scheme

running. One of the chief arguments against privatizing Social Security

is that it could be made to benefit individuals and corporations.

Third, as I wrote above, Ponzi schemes must collapse. Social

Security is sustainable; it has been sustained for most of a century,

and in its present form for most of that time. The contribution rate has

held stable basically my whole working life.

One critical thing

to remember is that benefits have never been denied. It’s doubtful they

ever could be. Old people vote. There are many ways to fix the

lack of reserve problem and many years to do it.

Social Security

was never designed to generate a profit or make its beneficiaries rich.

It was signed into law to provide a financial foundation for those who

could no longer do so for themselves. Secondly, a Ponzi scheme

specifically pays existing investors with the money collected from newer

investors.

IS SOCIAL SECURITY INCOME TAXED

TWICE?

In a recent discussion with someone the subject of Social

Security came up and they were extremely upset and insistent that paying

income tax on Social Security benefits was double taxation.

This seems to be a common misperception. What they don’t realize

is that Social Security is pre-tax money and calculated prior

to FICA (income tax) being calculated, just as are contributions to an

IRA/401K.

In essence, you are paying into a retirement account

managed by the government, and at the same time, reducing your taxable

income. Even neater is the fact that your employer matches it, giving

you an immediate 100% return in your Social Security account.

Furthermore, your Social Security income is not necessarily taxable. It all

depends on whether your total combined income exceeds a certain level

set for your filing status. If, for example, the only income you receive

is your Social Security benefits, then you typically don't pay any taxes

on it, nor do you even have to file a federal income tax return.

Combined income below $25,000: Benefits are not

taxable!

Combined income between $25,000 and $34,000:

Up to 50% of benefits are taxable.

Combined income above

$34,000: Up to 85% of benefits are taxable.

So no,

Social Security income is not taxed twice and for some, it is not taxed at

all.

A SOCIAL SECURITY BONUS?

You may have read the

following sentence near the end of news articles about Social Security:

One easy

trick could pay you as much as $22,924 more... each year!

Other articles mention a "$16,728 yearly bonus."

Those are

click-bait sentences. They are completely false. There is no "trick" that

will pay you any more than what you are already entitled.

The

longer you wait before you file, the larger your benefit will be. Each

month you wait, as I've already demonstrated, will increase your monthly

benefits a little bit... for life. It's as simple as that.

The monthly amount you are entitled to is a simply

formula, based upon your top 35 years with the highest indexed earnings.

If you continue to work and earn an indexed amount that is greater than

any of your top 35 years, your monthly check amount will increase.

Thus, the only "tricks" to receive a larger benefit are to 1.) keep working and

2) hold off on filing for

as long as you can.

THE SOCIAL SECURITY

DO-OVER

If you claimed early, and are currently

receiving benefit checks, are

you stuck with that decision?

No, not necessarily. Social Security

allows you to change your mind once during the

first year of receiving benefits. You are

allowed to pay back

everything you've already received that year. I believe it's

called Claim - Suspend - Restart.

THE SYSTEM IS FINE

Social Secuirty often gets a bad rap. However, the truth is,

most of us would NOT have saved or invested on our own, using that additional amount that

was taken from our very early paychecks.

We simply wouldn't have.

I know for a fact I wouldn't have. For

many, many years, especialy when I was in my early 20s, money was very tight. I needed every dime of my paychecks,

and then some. While living in Los Angeles, for awhile I had two jobs,

just to help

make ends meet. While on a two-vacation from one job, I applied

and worked elsewhere, until my vacation was over, when I then quit that new job.

When you are in your 20s and 30s and to some, even your

early 40s, "retirement" just isn't on your horizon. It's not even

a thought. "I'll worry about saving for retirement later" is just

too easy to do.

That additional 6.2% taken out of each

paycheck to fund the Social Security system turned out to be ideal.

I obviously got by without it. And now, If I start collecting Social

Security at age 67, for example, it will take less me than three years

before the total benefits I receive surpass the total amount I put it!

Less than three years. That's it.

Of course, a dollar back

in the late '70s was worth more than a dollar today, but even considering

that, the potential to receive more than I contributed, far far

more, is very possible and quite likely.

Once you retire, the real danger is not

dying too early, it’s outliving your savings. The best way for most

people to insure against that risk is to delay Social Security.

Social Security is fantastic insurance. It’s an inflation-adjusted

annuity that has zero default risk. There is simply no substitute for it

in the market. And although the Congressional Budget Office estimates

that changes will have to be made by 2033 to prevent a shortfall, that’s

a long time from now and there are many options for shoring up the

system.

You should treat Social Security as insurance against

the worst-case financial scenario, i.e., living a very long time. As

shown, this "long time" isn't really very long at all. Think of it as

Social Security is a government-guaranteed, inflation-adjusted annuity.

There is NO guarantee that interest rates in the future will be 5% or 4%

or even 3%... or have a positive return at all. At times, interest rates

are next to nothing.

WHEN

SHOULD YOU FILE?

Obviously, it's a personal decision.

The simple answer is, you should file when you need the money. If you need that money to live, if you need the money to

help support

yourself and put food on the table and roof over your head, then file.

If you need the money to pay for life's necessities (and

paying for streaming services and a daily Starbucks run can all be argued as a

"necessity") then file.

You should file if doing so

will allow you to do something you want to do, that you would not

otherwise be able to do if you didn't file. (Take a vacation, quit

work early, purchase an item, etc.) I would argue that if that is

the case, you didn't plan for retirement very well. You shouldn't

rely on having to take a permanent reduction in payments to do the things you want

to do at the age of 62.

If you file early, be aware that many years later, this small check you receive

each month most likely will not

be enough to cover all of your expenses. Be aware that if you complain about it,

it was you who put yourself in that situation in the first place.

You can also make a

case that if you have a strong indication you will not live

past the break-even age, based upon your lifestyle, your overall health,

the health and longevity of your parents and siblings, etc., you also

should file early.

Those are very good

reasons to file early.

Otherwise, if you can hold off on filing, even

for a few years, it is usually better to do so. A 42.86% benefit

increase, from what you will receive if you file at age 62 to the amount

you will receive at age 67, is excellent. That's an overall

average of a tad more than 8.5% a year, over those five years. (42.86% /

5 years = 8.571%)

Again, that 42.86% benefit increase, by waiting,

is guaranteed.

And you HAVE to consider the increase. You

not only have to consider the increase but you have to consider the time frame.

Those

two things are really the entire the basis for your decision!

If you had to wait, for example, seven full years and waiting only

increased your monthly benefit by 1%, I think we both would agree that's not

worth it to wait. Consequently, if you only had to wait one week to see

your benefit increase, and if it increased by 5,000%, we all would agree it's worth it to wait an extra week.

The increase percentage and the time frame to wait.... those

factors must be known before you can make a decision.

So, if you are talking to

someone about this very point... should they file early or should they

file late, and if they don't know (or don't care)

what percentage increase they will receive by waiting - if they can't

quote the actual figure and time frame - and yet they insist it's better to always "take the money now," they are making a

decision for a bad reason. They are making a decision without

knowing the particulars. They are making a decision

without knowing the two important factors.

After learning those

two factors,

they still might arrive at the same decision of course, but at least now

their decision is based knowing the facts.

The most common filing age is indeed 62. That

was my one-takeaway at a recent Social Security seminar I attended in

the city of Yorba Linda.

The gentleman giving the lecture said the most common reason for filing

at age 62 is that

most people simply need the money.

Again, if you are filing at

age 62 because you need the money, one can argue you didn't plan for

retirement very well.

You will often hear the reason

to file early is because "tomorrow isn't promised" and "you don't know

how much time you will have." To me, that's not a good reason to file

early. It's not a good reason to file early because that is just as valid of reason for

waiting to file!

Yes, we don't

know how much time we have left. So why assume it will be short?

Why are you necessarily assuming you will pass away before you collect a

worthwhile amount? Why not bet on yourself?

For me, I'm not

worried at all about the possibility of leaving any money on the table

by delaying benefits for a few years.

If I pass away before I collect any benefits at all, or if I pass away

before the break-even age, so what? That won't matter or bother

me. I'll be dead! Things can't bother you when you are dead.

What's much, much more important is the possibility of outliving my

savings. What's much, much more imporant is not having enough

money to do the things I want to do, while I'm in my 70s and 80s.

(And yes, many people in that age bracket are quite healthy and active.

Not everyone is reducted to living in nursing home.

The best way to

guarantee that is to wait and file as late as

possible. If you live past the break-even age, the additonal

amount you receive each month is substantial.

I believe I have a better chance of

living to the age of 81 than I do of dying before that age.

For me, it's worth it to wait and delay benefits for as long as I can.

You can regret filing early. If

you live far past the break-even point, you certainly might regret filing

early.

However, if you suddenly/unexpectedly pass away before you claim any

benefits, you won't regret that... because

you'll be dead. You can't regret anything when you are dead.

Here's a question for you: If a 42.86% increase isn't large enough for you, and thus you choose

to file early at age 62, I'm curious to know how much larger the increase would have

to be before you would wait to file? A full 50% larger? 60%? 70%? What about

a 42.86% increase over just a four year period instead of five?

If your attitude is that you will take whatever

you can get right now,

you're simply not being honest.

YOU DON'T HAVE TO WAIT UNTIL THE BREAK-EVEN AGE

BEFORE YOU ARE "IN A BETTER POSITION"

Here's something else

to consider and this is very noteworthy. You don't have to wait until

the break-even age before you are in a better position.

First

I'll use an exagerated example to make my point, and then I'll use a more realistic

example.

We know the break-even age between filing at 62 vs

filing at 67 is 78 years and 8 months. At the age of 78 years & 7

months, which position would you rather be in?

Scenario #1:

You claimed Social Security at 62, you received $700 each month for a

total of $139,400. (199 months x $700 = $139,400)

Scenario #2: You claimed Social

Security at 67, you received $1,000 each month for a total of $139,000.

(139 months x $1,000 = $139,000)

Scenario #1 has received more money!

That's better, right? That's a more desirable position to be in,

right?

Uh... no. Scenario #2 right now is a much better

position to be in. The outlook and potential is so much better.

Yes, it took awhile to get there, but notice it didn't take the full 78

years and 8 months. It took less than that... a full month less.

You're in "a better position" in less time than the full break-even age

of age 78 and 8 months.

You can continue with that same reasoning. Yes, we've already seen how

it take a full 140 months, or 11.67 years, before a person who filed at

the age of 67 receives the same amount as a person who filed at age 62.

But it only takes

90 months, or just 6.4 years,

before that 67-year-old is 85% of the way there!

To clarify, in

just under six and a half years, a little more than half the time of the

full break-even time period, the

person who chose to take their benefits late has already received

85% of

the amount that the early filer has received.

85% is

significant.

It's even less time than that (slightly) for the few

who individuals who choose to wait until the age of 70 to start

collecting. Just 7.25 years after collecting at age 70, which is just

age 77 & three months, their total benefits received will already be

slightly more than 90% of what the person who started collecting at age

62 received... a full 15 years ago! Of course, this is not all

that surprising. It's not going to take long to catch up when your

benefit amount is 77% larger. (For example, a person who collects $700

at age 62 will receive $1,240 at age 70... which is a 77.14% increase.

(1.24 - .7) / .7 = .7714

What scenario looks more attractive to you?

Scenario #1: 77

years old, collected a total of $137,200 in benefits... and

receiving a $700 check each month, for life.

Scenario #2: 77 years old,

collected a total of $124,000 in benefits... and receiving a $1,240 check

each month, for life.

I'll take

Scenario #2 every time.

Yes, with Scenario #1, that person currently has received more benefits.

This is true. But the

potential for Scenario #2 is much, much greater.

Thus, you don't have to wait the full 11.67 years to put yourself in a

better position.

Here's another scenario.

Are you deciding to collect at age 67 or should you wait another three

more years and start collecting benefits until the ripe old age of 70?

We already know the full break-even point for these two years is age 82.5.

However, as we have just seen, you don't need to wait that long at all to put yourself in a

"better position."

Scenario #1:

Age 76.5, just six and a half years after deciding to collect early at age

67, you will

have collected a total $114,000 in benefits... and

you will be receiving a $1,000 check each month, for life. ($1,000

x 114 total months = $114,000)

Scenario #2: At that same age,

76.5, if you decided to wait and collect at age 70, you will have collected a total of $96,720 in benefits... and yet

you will be receving a check that is 24% larger... $1,240

each month, for life. ($1,240 x 78 months = $96,720)

Again, the potential for earnings is so much more with

Scenario #2. You've collected nearly 85% of the money of the

person who started collecting at age 67... and yet your monthly

benefit is a full 24% more.

(I hope it goes without saying

that your actual earnings will be different than all of these examples, but the

percentages are EXACTLY the same. Also note these

examples are the basic break-even ages, without COLA! And we've

already seen how COLA lower the break-even age!)

Again, if you need the money,

file! If you need the money, your decision is easy! In fact,

there's really no decision at all. But if you

don't need the money, if you can get by without it, especially

without sacrificing anything, it really is better to wait as long

as you can. You may not need the money now.. but you certainly might

need it in the future and you will be in a better position, even before

fully reaching that break-even age.

THE GOVERNMENT WANTS YOU TO DELAY FILING?

I

also often read

comments in online forums and comment sections on how the "government" wants you to delay taking

your Social Security payments.

Their belief is the government hopes you die before you collect anything. And thus,

you should do the

exact opposite of what the government wants you do, which means file

early as you can, to be sure to get your money early and "screw" the

government.

Good grief. Seriously?

First of all, the government doesn't care what you do.

They really don't. Furthermore, if they did care, the opposite would actually be

true. They would want you to file early. The funds in the system would not be able to sustain itself for

as long if everyone delayed in taking their payments. To clarify, if the majority of people take SS early, the system

actually lasts longer. And the reason is simple; the average person lives

longer

than the break-even points.

As proof, consider this example.

Assume we have 200 men in two groups of 100 men each, Group A and Group

B. Assume everyone in Group A files early at age 62 and receives

$700 a month, and everyone in Group B files late, at age 67 and receives

$1,000 a month.

What does the situation look

like exactly 19 years later, when everyone turns 81 years old?

The average man

at age 62 lives another 19 years. Let's assume everyone is average and

they all live at least this long. At that point, Group A was paid

a total of $15.96 million. (100 men x $700 each x 228 months =

$15,960,000.)

And yet Group B was paid a total of $16.8 million.

(100 men x $1,000 each x 168 months = $16,800,000.)

The

government handed out more money to Group B. And of course going

forward, Group B will receive even more each month, with each member

receiving a larger monthly check than those in Group A.

If the government did really

care what you did (they don't), and if they did want to pay out "as little as

possible," they would want you to claim your benefits early, like everyone in Group A did,

so the system doesn't pay

out as much money in the long run.

Thanks for reading this far.

I hope some of this was beneficial or informative to you.

Obviously, this information just scratches the surface regarding the ins

and outs of Social Security.

Finally, here's the table I promised earlier, showing the percentage

amount you will receive of your PIA (Primary Index Amount aka Full Retirement Amount) for every

possible claiming age. (You can find this table on the SSA.GOV

website, but I chose to carry out the amount to three significant

digits, instead of just one.)

AGE to

CLAIM

BENEFITS |

BENEFIT

PERCENTAGE

of

FULL RETIREMENT AMOUNT |

PERCENTAGE

INCREASE from

PRIOR MONTH |

|

62 |

70.0 |

- |

|

62 + 1 month |

70.417 |

.417 |

|

62 + 2 months |

70.833 |

.417 |

|

62 + 3 months |

71.250 |

.417 |

|

62 + 4 months |

71.667 |

.417 |

|

62 + 5 months |

72.083 |

.417 |

|

62 + 6 months |

72.500 |

.417 |

|

62 + 7 months |

72.917 |

.417 |

|

62 + 8 months |

73.333 |

.417 |

|

62 + 9 months |

73.750 |

.417 |

|

62 + 10 months |

74.167 |

.417 |

|

62 + 11 months |

74.583 |

.417 |

|

63 |

75.0 |

.417 |

|

63 + 1 month |

75.417 |

.417 |

|

63 + 2 months |

75.833 |

.417 |

|

63 + 3 months |

76.250 |

.417 |

|

63 + 4 months |

76.667 |

.417 |

|

63 + 5 months |

77.083 |

.417 |

|

63 + 6 months |

77.50 |

.417 |

|

63 + 7 months |

77.917 |

.417 |

|

63 + 8 months |

78.333 |

.417 |

|

63 + 9 months |

78.750 |

.417 |

|

63 + 10 months |

79.167 |

.417 |

|

63 + 11 months |

79.583 |

.417 |

|

64 |

80.0 |

.417 |

|

64 + 1 month |

80.556 |

.556 |

|

64 + 2 months |

81.111 |

.556 |

|

64 + 3 months |

81.667 |

.556 |

|

64 + 4 months |

82.222 |

.556 |

|

64 + 5 months |

82.778 |

.556 |

|

64 + 6 months |

83.333 |

.556 |

|

64 + 7 months |

83.889 |

.556 |

|

64 + 8 months |

84.444 |

.556 |

|

64 + 9 months |

85.0 |

.556 |

|

64 + 10 months |

85.556 |

.556 |

|

64 + 11 months |

86.111 |

.556 |

|

65 |

86.667 |

.556 |

|

65 + 1 month |

87.222 |

.556 |

|

65 + 2 months |

87.778 |

.556 |

|

65 + 3 months |

88.333 |

.556 |

| 65 + 4 months |

88.889 |

.556 |

|

65 + 5 months |

89.444 |

.556 |

|

65 + 6 months |

90.0 |

.556 |

|

65 + 7 months |

90.556 |

.556 |

|

65 + 8 months |

91.111 |

.556 |

|

65 + 9 months |

91.667 |

.556 |

|

65 + 10 months |

92.222 |

.556 |

|

65 + 11 months |

92.778 |

.556 |

|

66 |

93.333 |

.556 |

|

66 + 1 month |

93.889 |

.556 |

|

66 + 2 months |

94.444 |

.556 |

|

66 + 3 months |

95.0 |

.556 |

|

66 + 4 months |

95.556 |

.556 |

|

66 + 5 months |

96.111 |

.556 |

|

66 + 6 months |

96.667 |

.556 |

|

66 + 7 months |

97.222 |

.556 |

|

66 + 8 months |

97.778 |

.556 |

|

66 + 9 months |

98.333 |

.556 |

|

66 + 10 months |

98.889 |

.556 |

|

66 + 11 months |

99.444 |

.556 |

|

67 |

100.0 |

.556 |

|

67 + 1 month |

100.667 |

.667 |

|

67 + 2 months |

101.333 |

.667 |

|

67 + 3 months |

102.0 |

.667 |

|

67 + 4 months |

102.667 |

.667 |

|

67 + 5 months |

103.333 |

.667 |

|

67 + 6 months |

104.0 |

.667 |

|

67 + 7 months |

104.667 |

.667 |

|

67 + 8 months |

105.333 |

.667 |

|

67 + 9 months |

106.0 |

.667 |

|

67 + 10 months |

106.667 |

.667 |

|

67 + 11 months |

107.333 |

.667 |

|

68 |

108.0 |

.667 |

|

68 + 1 month |

108.667 |

.667 |

|

68 + 2 months |

109.333 |

.667 |

|

68 + 3 months |

110.0 |

.667 |

|

68 + 4 months |

110.667 |

.667 |

|

68 + 5 months |

111.333 |

.667 |

|

68 + 6 months |

112.0 |

.667 |

|

68 + 7 months |

112.667 |

.667 |

|

68 + 8 months |

113.333 |

.667 |

|

68 + 9 months |

114.0 |

.667 |

|

68 + 10 months |

114.667 |

.667 |

|

68 + 11 months |

115.333 |

.667 |

|

69 |

116.0 |

.667 |

|

69 + 1 month |

116.667 |

.667 |

|

69 + 2 months |

117.333 |

.667 |

|

69 + 3 months |

118.0 |

.667 |

|

69 + 4 months |

118.667 |

.667 |

|

69 + 5 months |

119.333 |

.667 |

|

69 + 6 months |

120.0 |

.667 |

|

69 + 7 months |

120.667 |

.667 |

|

69 + 8 months |

121.333 |

.667 |

|

69 + 9 months |

122.0 |

.667 |

|

69 + 10 months |

122.667 |

.667 |

|

69 + 11 months |

123.333 |

.667 |

|

70 |

124.0 |

.667 |

|